aurora co sales tax rate 2021

There is no applicable special tax. Did South Dakota v.

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

The County sales tax rate is.

. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Effective July 1 2022. The December 2020 total local sales tax rate was 8350.

The 55 sales tax rate in Aurora consists of 45 South Dakota state sales tax and 1 Aurora tax. The Colorado state sales tax rate is currently. 2022 Colorado state sales tax.

5 lower than the maximum sales tax in SD. For tax rates in other cities see Missouri sales taxes by city and county. This new rate structure will have little to no impact on approximately 80 of customers.

This is the total of state and county sales tax rates. 31 rows The state sales tax rate in Colorado is 2900. For tax rates in other cities see Illinois sales taxes by city and county.

For tax rates in other cities see South Dakota sales taxes by city and county. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle to a location in Colorado. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

The Arapahoe County sales tax rate is. The minimum combined 2022 sales tax rate for Aurora Colorado is. For tax rates in other cities see Colorado sales taxes by city and county.

Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. Aurora-RTD 290 100 010 025 375.

The minimum combined 2022 sales tax rate for Aurora Oregon is. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The minimum combined 2022 sales tax rate for East Aurora New York is 875.

The New York sales tax rate is currently 4. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Most customers use only around 5000 gallons or less during the winter and between 7500 and 8000 gallons per month annually.

The Colorado sales tax rate is currently. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. 6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax.

With CD 290 000 010 025 375. What is the sales tax rate in Aurora Colorado. 875 Aurora applies a 50 excise tax and the state charges 150.

The Oregon sales tax rate is currently. This is the total of state county and city sales tax rates. 4 rows Rate.

The County sales tax rate is. This is the total of state county and city sales tax rates. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

This is the total of state county and city sales tax rates. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. You can print a 9225 sales tax table here.

There is no applicable county tax or special tax. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. The 2018 United States Supreme Court decision in South Dakota v.

0375 lower than the maximum sales tax in MO. You can print a 85 sales tax table here. Ad Lookup Sales Tax Rates For Free.

What is the sales. This tax is applied to and payable from cultivation operations located within the City of Aurora. Annually if taxable sales are 4800 or less per year if.

With local taxes the total sales tax. The Aurora sales tax rate is. You can print a 825 sales tax table here.

Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. Interactive Tax Map Unlimited Use. 725 The statewide tax rate is 725.

Exact tax amount may vary for different items. Has impacted many state nexus laws and sales. Wayfair Inc affect Colorado.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. You can print a 55 sales tax table here. The minimum combined 2022 sales tax rate for Aurora Colorado is 875.

What is the tax in California 2021. There is no applicable county tax. The East Aurora sales tax rate is 0.

Groceries and prescription drugs are exempt from the Colorado sales tax. 275 lower than the maximum sales tax in IL. This is the total of state county and city sales tax rates.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. The minimum combined 2022 sales tax rate for Arapahoe County Colorado is. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax.

Did South Dakota v. The Aurora sales tax rate is. The County sales tax rate is 475.

Download all Colorado sales tax rates by zip code. 1281 per month service charge.

Illinois Sales Tax Rates By City County 2022

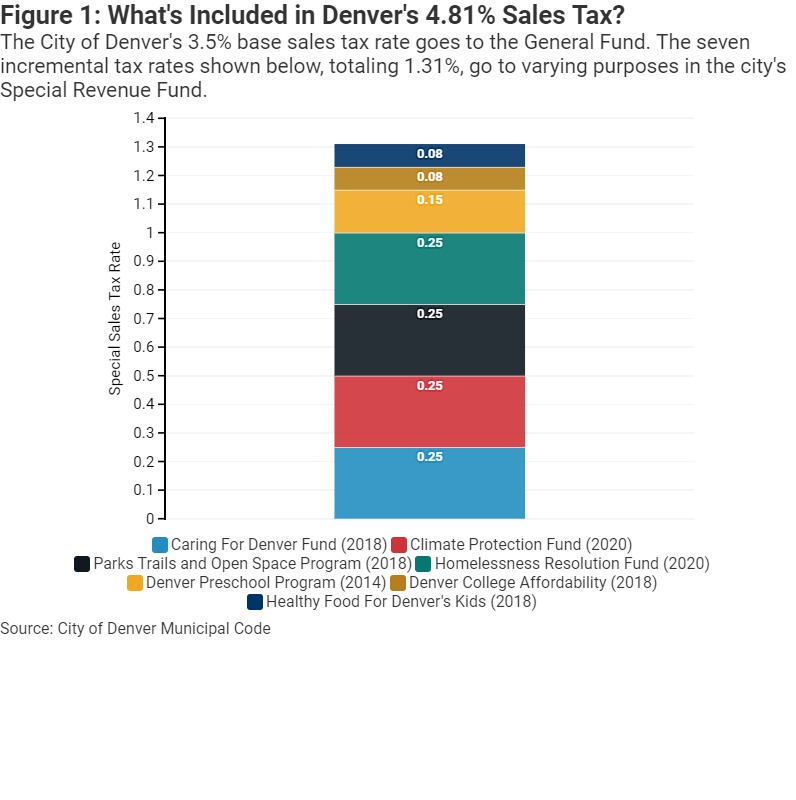

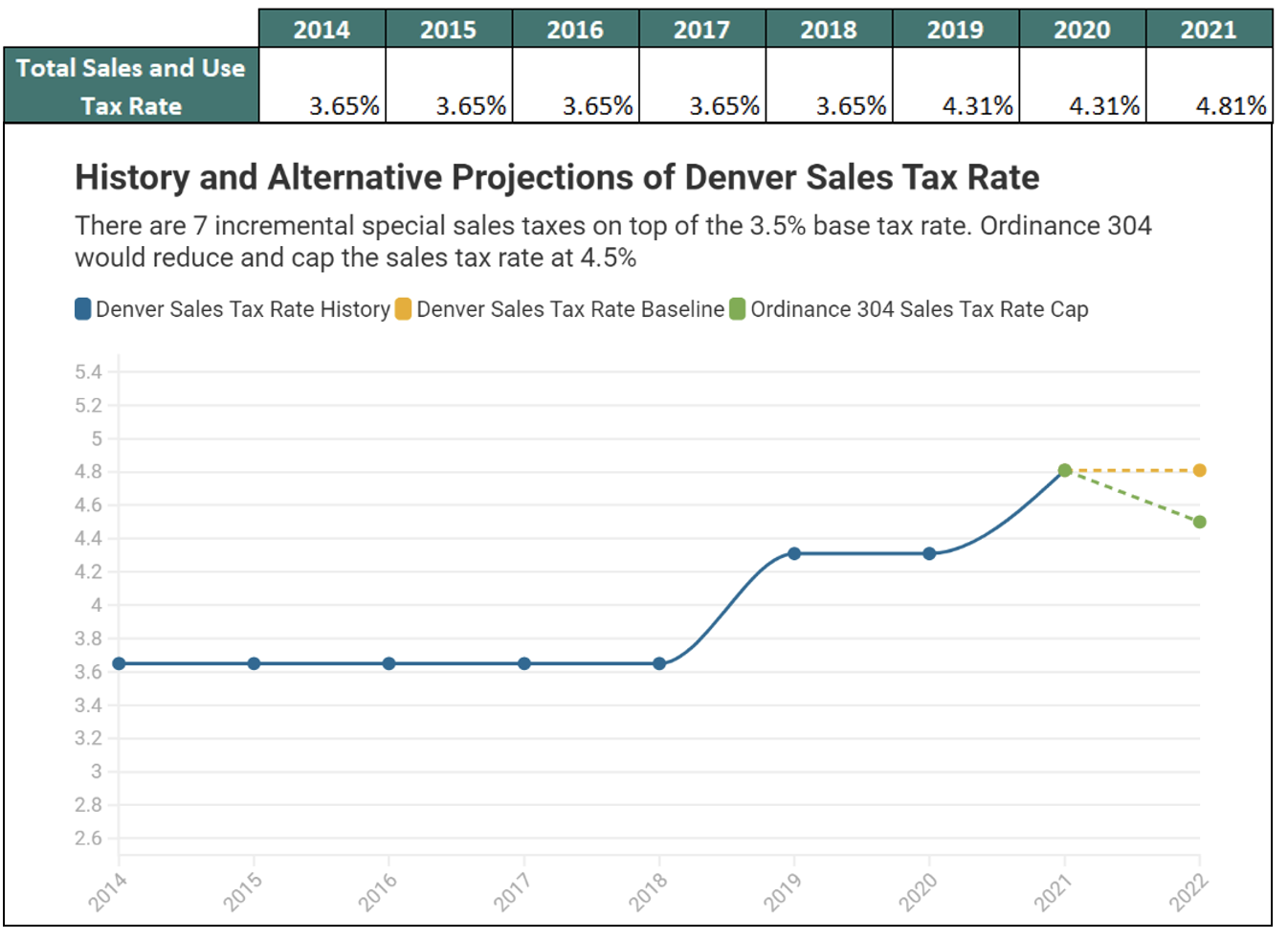

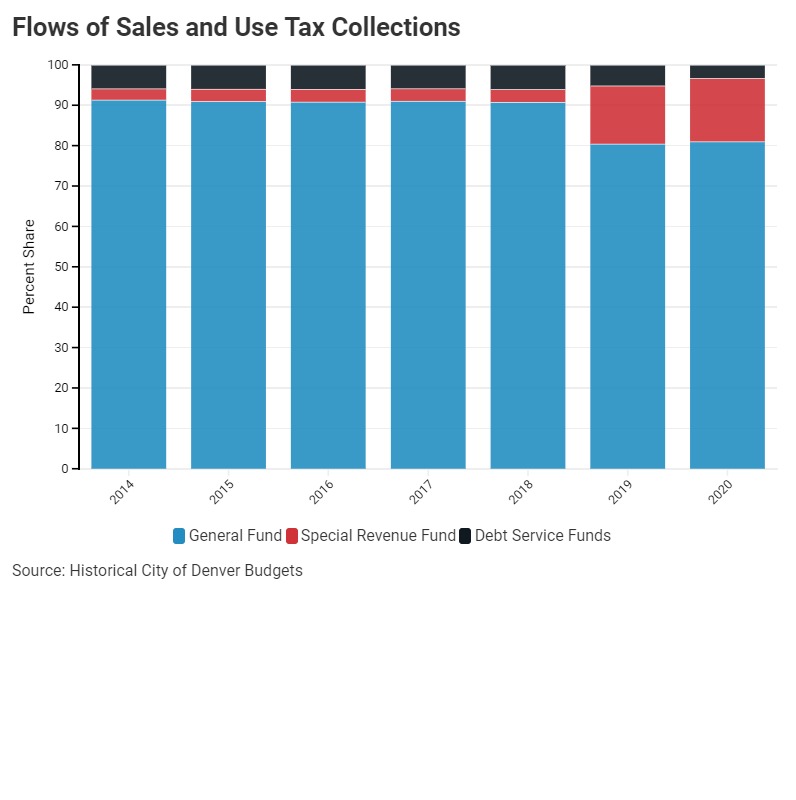

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

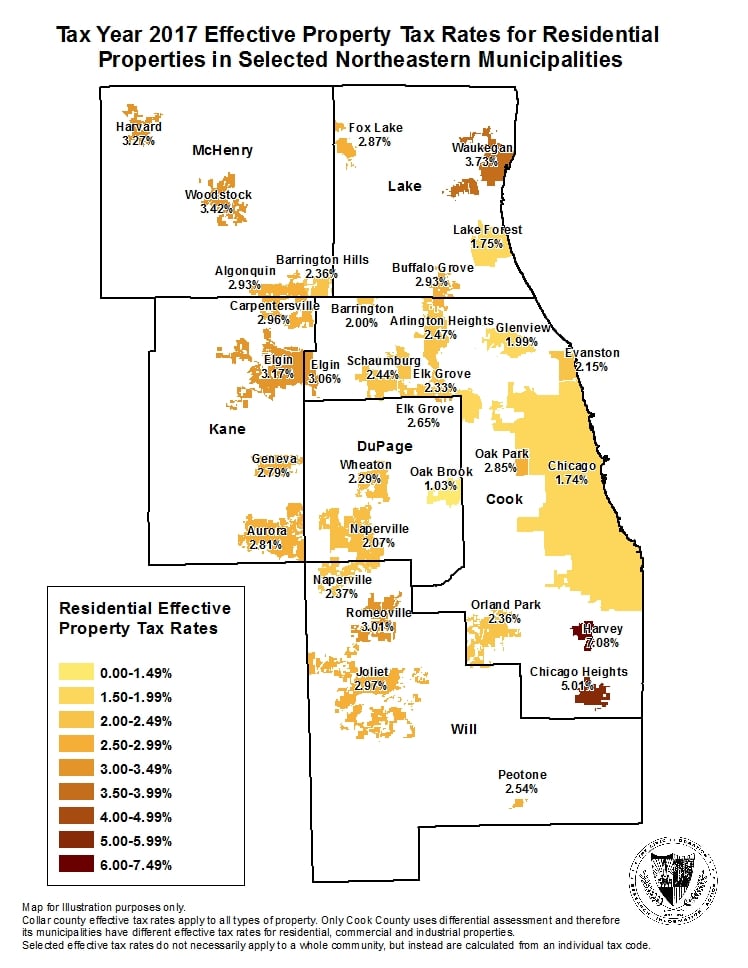

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

Sales Tax By State Is Saas Taxable Taxjar

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

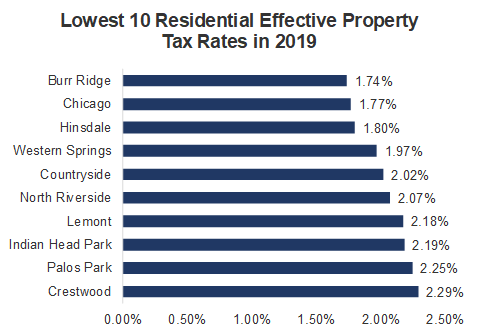

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

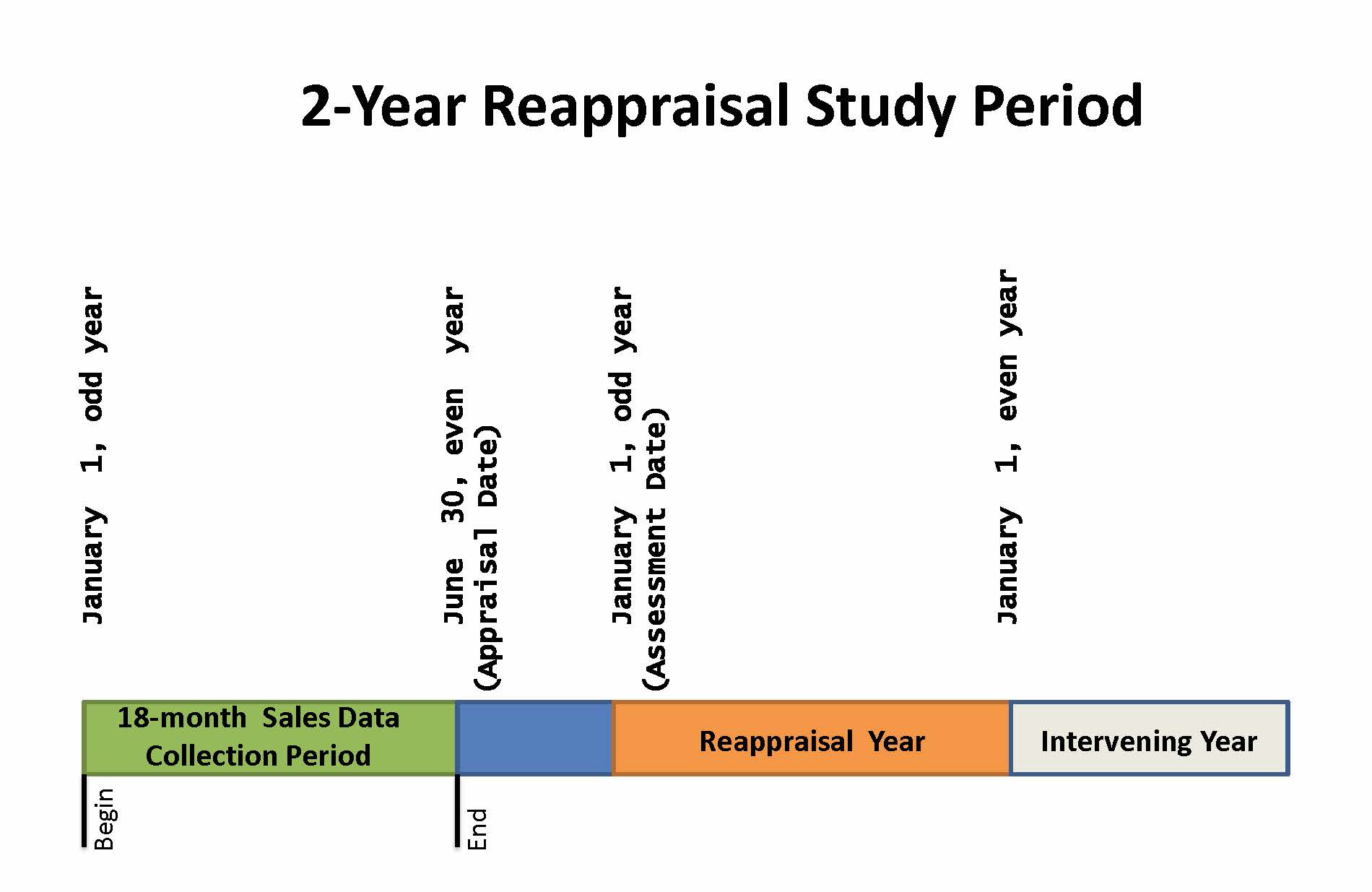

Property Assessment Process Adams County Government

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Nebraska Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To File The Colorado Retail Sales Tax Return Dr 0100 Using Revenue Online Youtube